SmartCredit offers an interactive credit report that’s easier to read and understand than a traditional credit report. Rather than making you scroll through pages of account history, the Smart Credit Report lets you flip through your credit report information piece by piece as if you were turning the pages of a book.

What Can You Do on SmartCredit?

As you view each tradeline on your credit report, SmartCredit lets you take a variety of actions based on the information. For example, you can:

These are sent directly to the creditors or credit bureaus electronically and their response is sent back the same way. The benefit is that you don’t have to worry about having the right address or account number.

When you sign up for SmartCredit, you’ll get access to the VantageScore 3.0. The score is great for educational purposes to get a feel for where you stand, but be aware that the lender may use another credit score.

You can easily gauge your credit standing with a variety of credit scores: a traditional credit score, an auto score, an insurance score, and an employment score. This may be the most comprehensive set of scores available in any one monitoring service.

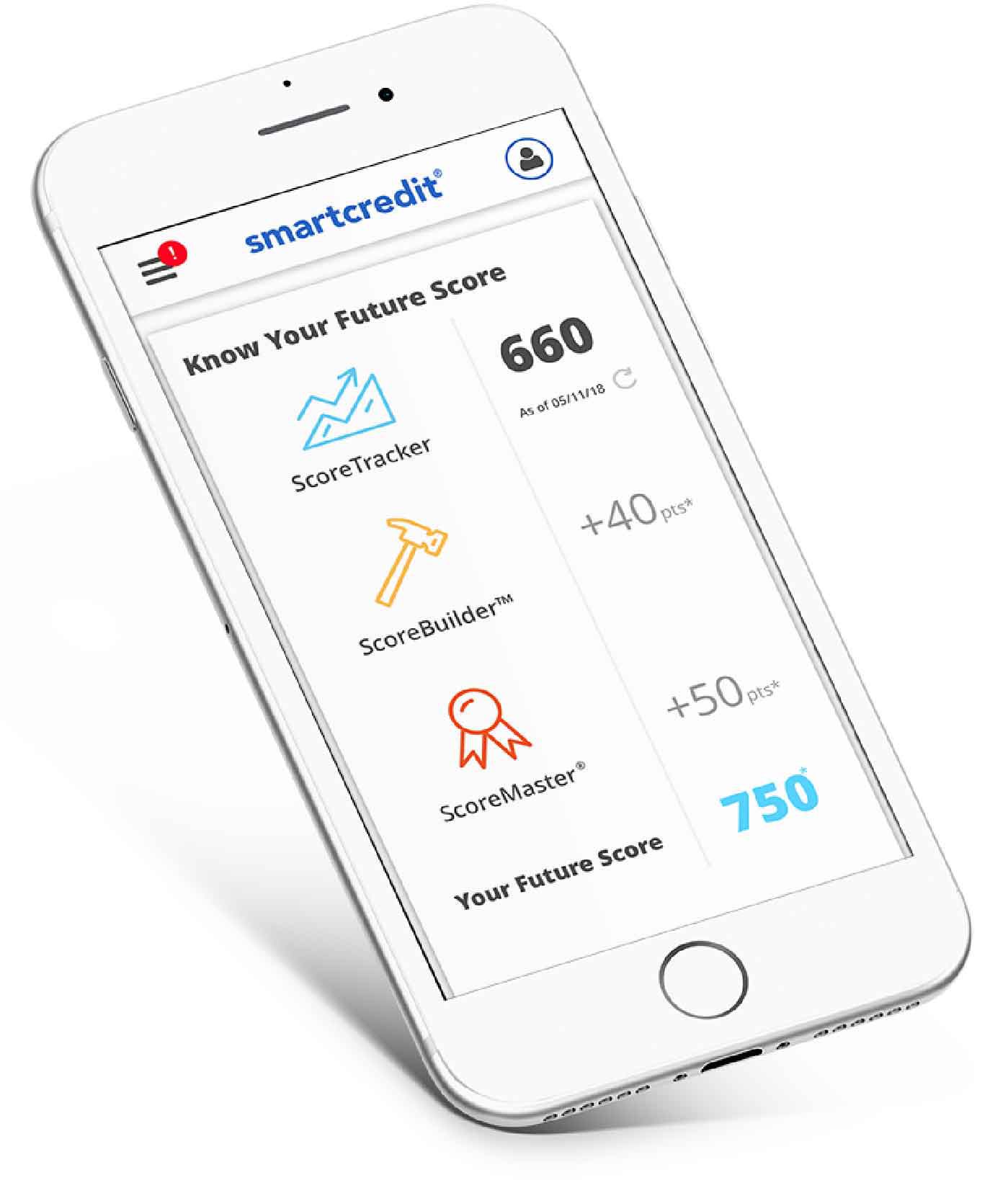

Additionally, the ScoreBoost future score simulator lets you gauge how your credit score would improve if you took specific actions against your credit, such as having a debt removed via goodwill letter.

Subscribing to SmartCredit will also give you access to a few other apps, such as the Jean Chatzky ScoreBuilder, which helps you improve your credit score in 120 days, and the Debt Negotiator system for settling debts on your own.

Monthly Cost

SmartCredit offers two membership levels: basic and premium. The basic membership is currently priced at $19.95 per month and comes with two monthly updates to your credit report and score and unlimited access to the ScoreTracker, ScoreBuilder, ScoreBoost, Credit Monitoring, and Money Manager. You can also take five credit actions each month.

The premium membership, priced at $27.95 per month, offers all the same benefits of the basic membership plus unlimited updates to your credit report and score and unlimited credit actions.

Both membership levels offer a la carte access to your reports and scores from all three major credit bureaus and $1 million in ID fraud insurance. Activation is required for the fraud insurance benefit. SmartCredit offers a seven-day trial and a risk-free offer. If you cancel within seven days, you pay nothing. If you cancel after seven days, you agree to pay any accumulated, unbilled charges through the date of your cancellation.

The Bottom Line

SmartCredit presents an interesting and easy-to-understand way to look at your credit report. The $19.95 price is comparable to what you’d pay for a credit report and score from a bureau, but SmartCredit grants you access to much more information than a standard credit report. While you can complete correspondence with your creditors with templates you find on the internet or letters you create on your own, having the option to submit quickly and directly through the app is a nice feature.

Unfortunately, there isn’t a more basic version of SmartCredit for users who only wish to view their credit report and scores, so the price point may not be worth it if you don’t need all the extra features. Still, for those who want a comprehensive credit reporting and management app, SmartCredit offers plenty of compelling features.

Note

The company provided free access to this service for review purposes. For more information, please see our Ethics Policy.